On November 15, 2022, I wrote an Energy and Capital headline reading, "Buy Oil, Buy Mexico."

I continued:

There are two big investment themes going on right now. The first is obviously energy. The second is deglobalization, revamped supply chains, and nearshoring.

The macro environment makes it very difficult to invest in China right now. The big trend, if you are a manufacturer, is to get out of China and somewhere closer to your customers before things get really bad. China is still in rolling lockdowns; its dictator Xi Jinping seems to have no understanding of the stock market or the economy, and anyone left who could tell him would rather keep their head.

Furthermore, the Biden administration started a new technological cold war with China with the CHIPS and Science Act. Everyone is underestimating the coming fallout. Companies can avoid tariffs if they produce in Mexico, which is part of the new United States-Mexico-Canada trade agreement negotiated by Trump.

It turns out I was correct on all of these predictions.

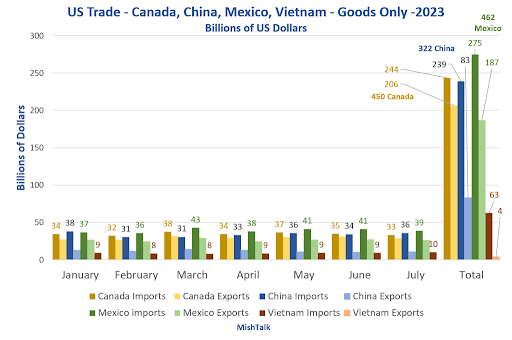

Last week, Mexico blew past Canada and China as the U.S.’ largest trading partner.

This is all part of the nearshoring trends I’ve been talking about for the past year. I’ve recommended a number of Mexican stocks in my Bull and Bust Report service. They are all in the green with a lot more upside. No one is talking about the Mexican story. We are still very early. Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

The Middle Kingdom

As for China, Biden has kept all the tariffs in place that Trump installed and even added to them.

China has a hard row to hoe. It has gotten old before it's gotten rich. The Chinese population is declining. Youth unemployment is over 20%, and the country is dealing with a massive real estate crisis.

Today’s news is that one of its largest real estate companies, Evergrande, has missed a payment on a $550 million onshore bond. The stock fell 25% yesterday morning. Furthermore, the company canceled a meeting with bondholders.

Evergrande's former CEO Xia Haijun and former CFO Pan Darong have both been arrested by the Chinese authorities.

In July, Evergrande reported a loss of 105.9 billion yuan ($15.7 billion) for 2022, following a loss of 476 billion yuan the previous year. Its total liabilities reached nearly 2.6 trillion yuan at the end of 2021 before falling slightly to around 2.4 trillion yuan a year later.

The company is responsible for many of those unfinished cities you read about and see on YouTube. This is devastating news as the defaults may cascade through the Chinese economy. According to Fortune, 70% of Chinese people keep their wealth in real estate.

As far as oil prices go, WTI currently trades at $89 and change. We are in a supply crunch with OPEC+ cutting production and global demand picking up. If prices break through $105, we are off to the races.

All the best,

Christian DeHaemer Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.